If you’re a B2B MarTech Startup and expect to tap into VC funds, I’ve got some good news and some bad news! Which do you want to hear first?

The future looks bright…especially for Data and AI

According to a recent post by noted Forbes Enterprise Tech contributor Louis Columbus:

- 83% of B2B marketers are going to focus more and invest in data analytics in 2020 according to a recent survey by Dun & Bradstreet.

- Spending on AI-based marketing technology (martech) solutions is projected to reach $52.2B by 2021, attaining a Compound Annual Growth Rate (CAGR) of 46.2% from 2016 to 2021, according to the International Data Corporation.

22% of marketing organizations are planning to increase their spending in 2020, according to a survey by BDO, WARC, and the University of Bristol. Their results reflect the strong demand for marketing technology (martech) solutions globally. BDO found that marketing automation budgets increased 25% last year, and the martech industry in North America and the UK is $65.9B, with the global market estimated to be $121B.

Scott Brinker, leading authority on martech, VP Platform Ecosystem at HubSpot and Editor at chiefmartec.com, commented in the BDO survey that “the martech industry continues to paradoxically consolidate and diversify. While the total number of martech apps in the world continues to grow, leading marketing platforms — such as Adobe, HubSpot, Oracle, and Salesforce — are increasingly orienting around the ecosystems of these apps. The platform provides coherence in marketing data and workflow, while the app ecosystem provides a long tail of specialized capabilities and vertical market solutions. Consolidated platforms with diversified ecosystems have the potential to give the market the best of both worlds and help marketers harness the tremendous energy of the SaaS app explosion.”

Okay, but is VC in love with B2B…?

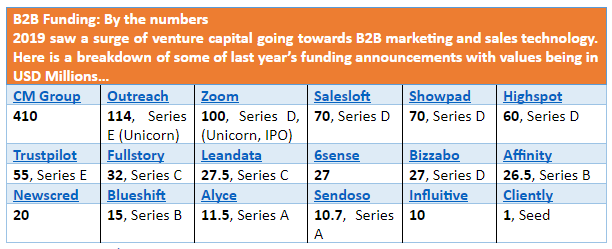

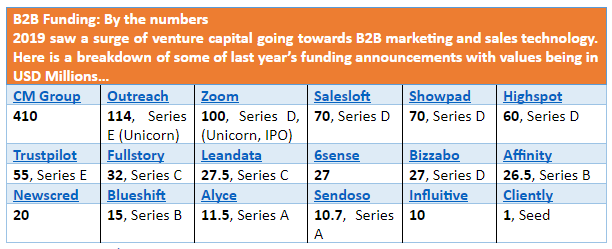

Everybody loves a winner. And winners and their backers are always keen to publicise their “success”. In the past year or two, the winners have been many and varied, with firms such as Zoom, Affinity, Trustpilot, LeanData, and Bizzabo cleaning up big time, to name a few.

Source: Demand Gen Report

All good…but what does that mean for you, the MarTech Startup?

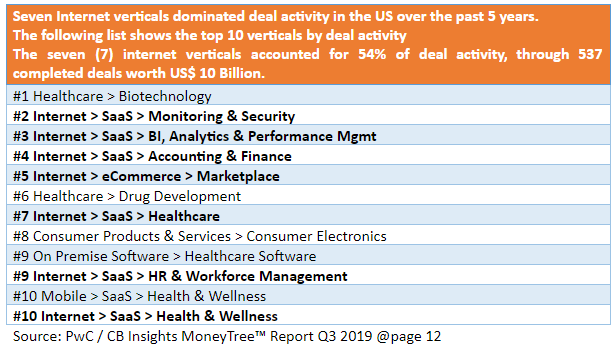

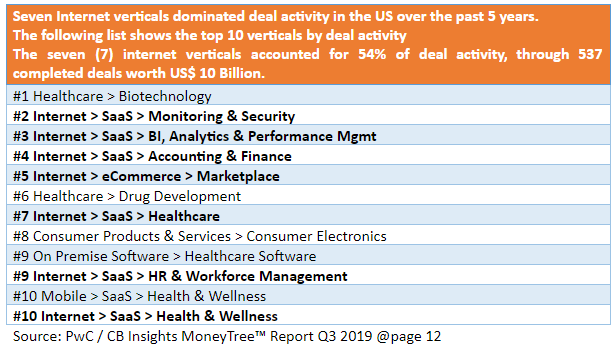

Firstly, it means that there’s never been a better time to enter the market as a MarTech Startup, apart from 2018, which saw new highs in VC investment that had not been hit in the previous 10-year period. And that’s according to the big data-based strategic information (research) publication guru CB Insights, who along with PWC compose a report each quarter called Money Tree Report.

And secondly, the B2B sector generally and MarTech specifically have captured the attention and cemented the support of many of the VC Sectors dominant teams (VC Royalty) like 500 Startups, Techstars, DFJ, Sequoia Capital and Y Combinator.

Source: Venture Scanner

What’s behind the B2B/MarTech VC investment frenzy and is it just a fad?

So, what has driven investment firms to focus on B2B tech above B2C? B2B tech has evolved heavily since the emergence of marketing automation. B2B companies have learned from their B2C counterparts to innovate, scale and focus on the customer journey.

At the same time, marketing tech stacks have grown more complex, with innovative point solutions helping marketers fill in gaps that marketing automation and CRM systems can’t offer in detail. For Kelly Ford, Investment Partner at Edison Partners, this means focusing their investments on solutions that are integrating with or doing something to enhance marketing automation. Ford noted that, from an investing perspective, there is more of an opportunity to consolidate the market.

“I’m now to a point where I’m less interested in placing the early bets as we did with companies like Terminus, PathFactory, and Sigstr, and more interested in where the synergies are, and how some consolidation can start to take place in the space,” said Ford.

Okay, so it’s all good news then? Well, no…

Ford’s views expressed above are echoed in conversations I’ve recently had with VC Partners in Singapore. It represents both an opportunity and a threat. The opportunity is that MarTech focussed VC funds are springing up and will invariably have to earn their stripes by looking at hundreds of potential business models and teams before making their investment decision. The threat is that some VC’s have already lost their appetite for risk, which means that only larger more established companies that are well and truly revenue positive will attract their interest. Which in turn means that Startups with a great team and disruptive product/service/business model, and not a lot of partner capital, will have to bootstrap even longer, or pivot or wind up the business.

While the surge in tech funding has been active in 2019, investors have had their eye on B2B startups for quite some time. However, just because a company has raised significant capital, Ford noted that this does not guarantee future success.

“I do think it brings credibility, but when there is actual direct competition and tons of capital going into a category, you’ve got to look at it sideways a little bit. Don’t just praise the company for their ability to raise that much money, but ask ‘what have they done with it?”

The irony is that a MarTech B2B Startup needs a lot more capital to get to the same stage as its B2C brother…

As the entrepreneur and investor Jason Lemkin states: $750k gets you very far along, post MVP, in a consumer start-up. In the enterprise, it gets you almost nowhere. A prototype, yes. Customers? Maybe not. A sales team? No way. Demand gen marketing? Fuggedaboutit. It’s $2M to get anywhere.

And there are dangers of being seen as a VC darling – or put another way – the WeWork collapse effect…

Forty-seven billion dollars. Such was the valuation of WeWork just months ago. “How do you change the world?” founder and CEO Adam Neumann asked at the time. “Bring people together. Where is the easiest big place to bring people together? In the work environment.” And with such big dreams, he steered the company towards a public offering.

As we know, the valuation has now plunged by over 80%, and the company is on the brink of bankruptcy. It’s scrambling for cash to stay alive and continue to serve its customers.

Sure, but what’s that got to do with a MarTech Startup looking for funding?

Trust is everything! Customers entrust mission-critical processes with startups, often without fully realizing the risks they are taking when they give their business to financially unstable firms. When such startups suddenly collapse, not only are customers’ businesses badly damaged, so too are the careers of the employees responsible for the vendor relationships in the first place.

Examples of such disasters abound; here’s the reaction of a CIO who found that his CRM platform provider had gone bankrupt:

“Then the day arrived. I got a phone call telling me that the provider had gone under…We were put on notice that in 24 to 48 hours that all of this was being turned off.”

This risk to businesses, as well as to people’s careers, is an inherent product of our venture capital-funded startup ecosystem. When vendors are funded by speculative investment rather than their economic success, they can appear robust when, in reality, they’re startlingly fragile.

This phenomenon is on full display in the marketing technology ecosystem.

Okay, have you remained undaunted and still want to secure $2M upwards from a VC or VC syndicate? Here’s what you need to know…

VC Partners are not co-founders, they invest under the most stringent of parameters via lengthy legal documents, they are supposed to bring additional value besides the money, which by the way, you won’t get in one lump sum, rather against milestones, but it’s been my experience that not all, or not even the majority of them that are now the Managing Partners of VC Firms have invested their funds and started up a MarTech company. They may have hands-on operational experience in starting up a company in another sector, or they may be career investment, finance and M&A executives that come from an Investment Banking background.

VC Partners are not investing the money because of some kind of deep philosophical “pay it forward” belief.

It’s generally not even their money. A VC firm is a business. Just like your business, they target customers and try to sell a product. In this case, the product is an ROI that will outperform the benchmark – whatever index that maybe – but in a lot of cases the magic number is around 12% annualized ROI. Their “customers” are other entities that accumulate money from their members like Family Officers, Pension Funds, Sovereign Wealth Funds, and other Investment Funds. The more money they raise, the more they earn in Management Fees and/or profit share or equity in the VC Firm.

Doing due diligence on a company needing funding is a time-consuming task for the VC. You need to prepare all the documents that they require fully and accurately, as well as practice presenting the information contained in your sales pitch so you can answer the many questions that they will ask you confidently, genuinely and on the first occasion.

Be prepared to receive 100 “no’s” to get one “yes”.

If you want to stack the deck in your favor, beat them at their own game…

The best way to get a VC’s attention and increase your chances of getting a yes is to buy yourself some insurance. Not the Generali, AXA or Prudential type. Try to enlist the support of a Mentor or a group of Advisors who have been through the Startup + MarTech + VC funding process before. You need to have at least one Senior Executive on your team that understands exactly what VC’s mean, think and want. In some cases, you will find one or more people who will help for free. But if you can’t, if you find the right person and they have come to you via a recommendation from someone you trust, and/or you can verify their credentials, then it’s worth your while to pay them for a short term period until you have given the VC funding your best shot and either succeeded or realized that it’s not a match.

If you treat the VC’s like a potential B2B client and approach it the same way as you would any other customer that is critical to your company’s survival, you are bound to have a different attitude and perspective than most companies raising funds to do.

My final words of advice to you are that if you want to make a good impression when you make your first (and in most cases only) investment “pitch” to a VC is: Be yourself. Prepare meticulously. Show your passion. Lose the hype.

[…] in one of the previous blog posts, James Spurway has already covered what a martech company needs to get funded, I will touch upon a few supercritical […]

[…] in one of the previous blog posts, James Spurway has already covered what a martech company needs to get funded, I will touch upon a few supercritical […]